Pitch Deck Playbook, part 2

I’m moderating a panel on startup fundraising tonight with a group of entrepreneurs called Miami Made. We’ll have some terrific founders who’ve successfully raised money in South Florida, which is not always as easy as it seems.

The two topics we'll cover are: 1) How to raise your first money. That’s the hardest. It gets easier…and by your second startup you’re a pro! 2) When not to raise money. Sometimes it's better to focus on building a successful business. Once you do that the money will follow.

Pitch decks are an important part of the fundraising process, and I’m reviewing a few this morning and want to point out what works well vs. what can be improved. You can also check out my first post on pitch decks here.

Here are some areas we’ll cover:

- Competitive Landscape

- Financials

- Market Size

- Marketing Plan

- Unit Economics

- Marketing Funnel

Here's the video walkthrough:

Competitive Landscape

One of these pitch decks states that:

“Barriers to entry are small to non-existent. Our company with it’s first-mover advantage can become one of the industry leaders.”

Yikes!

First, barriers to entry are important and investors want to see them. A barrier to entry is something your company creates that makes it harder for competitors to copy or compete with you.

Second, first-mover isn’t an advantage. Just ask any company that’s been crushed by Apple or Microsoft. Or ask Snapchat about Stories now that Instagram is copying them.

Jason Cohen covers unfair advantages in two great blog posts: No, That IS NOT a Competitive Advantage, and Real Unfair Advantages.

Financial Projections

If you’re raising money and need investor-ready financial projections, please check out my Rocket Pro Forma template (and I’ve posted other resources for startups there as well).

Here are financial projections from one of the pitch decks:

First, I like the base case vs. the upside case, although it’s probably not necessary in a pitch deck.

Second, I like the annual summaries, but I want to see monthly numbers for the first year.

Third, I would note that all numbers are in thousands—including downloads per year. It took me a minute to figure that out and I look at financial models all the time.

Now for the sanity checking. Getting 1.5 million people to download and use your app in a year is hard! And expensive!

Snapchat is incredibly popular, yet only 22% of people who install the app continue to use it after 21 days. Business Insider recently noted that less’ than 1% of Blippar’s users return after 21 days.

Your results will probably be somewhere in the middle.

Next, my guess is that your paid CPI (cost per install) will be between $2 and $3, so 1.6 million installs would cost between $3.2 million and $4.8 million—but you’re saying your total expenses will be $3.766 million.

That doesn’t leave you any money to pay salaries, rent, etc. so now I’m skeptical about your entire plan.

Financial Projections, Part 2

Startups are all about innovation—but it’s not a great idea to innovate in the way you present your financials.

You’re asking the investor to do a lot of work here:

- I want to see a standard spreadsheet view with revenue, cost of sales, expenses, and EBITDA.

- I also want to see expected unit sales, # of units required to breakeven, and headcount (so I can sanity-check revenue per employee).

- I want to see annual summaries and a monthly or quarterly breakdown for the first year or two.

- That dark blue line is expenses, but it makes it look like the company doesn’t need to raise money. Meanwhile the entrepreneur is asking for $2 million. So I’m confused.

Market Size

This pitch deck has some market size info for a dating app:

In general I want to see that your startup is positioning itself to benefit from a big trend, so this info is great! You’re telling me that dating apps are hugely popular, the market is growing, and 85% of potential customers are waiting to be signed up.

Good to know, and now I’m interested.

Here’s the market size info from another pitch deck:

What’s missing here is the growth rate. I don’t just want to know the size of the market, I also want to know how quickly it’s expanding. A rising tide lifts all boats.

Marketing Plan

Here’s the marketing plan from one of the pitch decks:

This is a great start, but it doesn't give enough info. Most companies attempt some combination of these initiatives, but each requires work and it's unclear which will be effective until you start testing. This slide basically tells the investor, “We’re planning to spend a bunch of your money on marketing—but we're not sure whether it will work.”

It’s helpful to bring some data into the pitch deck:

This tells me a few things: first, you’ve done a bunch of testing so you already have an idea of where best to spend your investors’ money.

Second, you’re running experiments and learning from the data. This is exactly what investors want you to be doing, since no one can predict the future.

Unit Economics

I also love it when your pitch deck gives me your unit economics. This tells me that you’ve done your homework and that investors can trust you with their money.

It also shows me that you have the potential to make real money because your cost to acquire each customer (CAC) is dramatically less than each customers lifetime value (LTV). The larger the difference the better.

Marketing Funnel

This pitch deck also includes the actual marketing funnel:

I’ve hidden the revenue number, but this gives me enough info to plug in my educated guess at cost per click (CPC) and compare it to the revenue generated.

This lets me do the same thing as comparing CAC to LTV above, where I can estimate how profitable this business can become.

I’ll also sanity check this against the market size since there isn’t an infinite number of customers—unless you’re Google or Facebook (and even they are hitting the wall so they're figuring out how to bring Internet to developing markets in order to sign up more users).

Summary

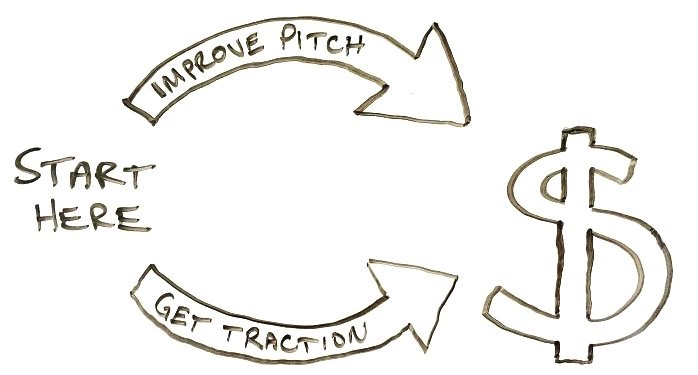

Investors hear lots of ideas, so your idea usually isn’t enough to convince someone to write a check—unless they’re friends and family and/or you've already been successful.

Your pitch deck needs to tell the story of your vision, why you’re the right team to do this, the trend you’re benefiting from, and the work you’ve already done to support your claims.

The best entrepreneurs are always moving the ball down the field regardless of whether they've raised money yet, and investors want to bet on the best entrepreneurs.

Mike Lingle is obsessed with helping founders grow their businesses. I'm a serial entrepreneur, mentor, and executive in residence at Babson College. Check out my Rocket Pro Forma if you want to quickly create your financial projections.

Building an entrepreneurship hub for international founders in Miami

7yBest pitch deck Guru: Mike Lingle! Great conversations yesterday at miami made event

Helping businesses reach their full potential through strategy and systems optimization

7yThe point about seeing your market as a breathing organism is excellent advice. Investors aren't going to hold their breath and wait for their return; they want to see how a) you define your target market; and b) how that market is actually growing (or declining). It's so easy for startups to find a market cap statistic and say "YES! Our market is $638B!!" When in reality the market may be downsizing or transitioning in needs and wants. Building on what Miles said, it's as important to know (and understand) your market as you would an investor or customer.

Empowering global supply chains & building next-gen, freight platforms. #AI #PLG

7yAwesome post, Mike. Thanks for putting this together and great insights. My big takeaway is that raising funding is a 'selling' process & trying to find product market fit, with PMF being a successful raise. It's similar in that it is relationship based, has to be managed and tracked (CRM), and also should be approached from a customer development standpoint to 'uncover' these key points you mentioned here. To raise, one has to empathize and understand the way VC's operate.