CNBC: 90-day pauses are not an eradication of tariff risks, says RBC’s Frances Donald

Published April 9, 2025

Frances Donald, Chief Economist at RBC, joined CNBC’s 'Power Lunch' to discuss the market rallying on news that Trump is pausing tariffs on certain countries for 90 days.

Click here to watch her CNBC interview.

Bloomberg: S&P 500 may fall 27%-32% in recession: RBC’s Calvasina

Published April 7, 2025

Lori Calvasina, Head of U.S. Equity Strategy at RBC Capital Markets, joined Bloomberg Surveillance to discuss Recession pricing, lowered S&P500 targets, how to price the current market environment as tariff turmoil spreads, and more.

Click here to watch her Bloomberg interview and listen to her on Bloomberg Talks and Single Best Idea.

Tariffs won’t show up in core goods inflation just yet

Published April 7, 2025

Following “Liberation Day” tariff announcements and in the wake of a continued deterioration in the “soft” economic (sentiment) data, this week’s U-Michigan survey will likely show another rise in inflation expectations. Against the backdrop of steep tariffs, we are watching closely for stagflationary risks in the economic data. But announced tariffs won’t show up in the inflation prints just yet!

In fact, we anticipate a slowing in core inflation in March as our forecasts call for a month-over-month rise of 0.2% in both the headline and core measures.

- Core goods sector inflation is likely to hold steady as announced motor vehicle and parts tariffs did not go into effect until April.

- Services sector price growth should continue to outpace goods, at least for another month.

- Weaker gas prices in March will provide some downward pressure to headline inflation. We will likely have to wait until the April report to see the impact of higher auto prices on core goods.

Last week’s ISM manufacturing prices paid index – a leading indicator – suggested that the share of firms facing higher prices rose drastically in March. We expect this to be reflected in core goods prices in the months ahead. We will be watching to see if the spike in used car prices relative to prices for new cars– which we saw in February’s CPI report– continues. This could signal a further deterioration in consumer purchasing power.

Multi-industry take on tariff impact

Published April 7, 2025

The biggest casualty from the unfolding trade war is likely to be CEO confidence, with a resulting snowballing of project delays, pushouts, cancellations, and lowered capex. The upcoming earnings season will likely be especially unsatisfying, since managements will only be in position to cautiously discuss their preparedness to raise prices and control spending, with few specifics about any changes in demand. We will not be surprised to see some companies pull guidance.

Companies best positioned to weather tariff impacts should be the high-earnings quality names and companies leveraged to defensive end markets, such as water. Companies more at risk could be those with higher exposures to auto and electrical.

According to the UN Comtrade database, the most imported categories/goods to the U.S. in 2024 were (1) machinery, nuclear reactors and boilers (HVAC), (2) electrical, electronic equipment, and (3) vehicles.

What’s next for the multi-industry sector?

- Near-term, expect the sector to deal with a spike in Cost of Goods Sold (COGS) due to higher imported materials costs; there is likely to be a falloff in short-cycle demand.

- Broadly, sector is comparatively less exposed to imports/exports given prevalence of in-country/ for-country manufacturing and some degree of de-risked sourcing strategies post-pandemic.

- The less-draconian treatment of Mexico was a modest positive, especially for the HVAC OEs.

- Playbooks will likely be to offset tariffs with price hikes and surcharges, leaning on the experience gained from Trump 1.0 tariffs.

To access the full report, contact your RBC representative.

CNBC: RBC’s Helima Croft on OPEC+ producers raising crude oil output

Published April 4, 2025

Helima Croft, Head of Global Commodity Strategy at RBC Capital Markets, joined CNBC’s ‘Power Lunch’ to discuss the oil market as eight OPEC+ producers accelerate crude oil output hikes, whether the price of oil goes lower, and more.

Click here to watch her CNBC interview.

March job surge coincides with front-running of tariffs

Published April 4, 2025

The March payrolls report showed a significant upside surprise - with 228k jobs added. A surprise uptick in leisure & hospitality (after weakness in February) coupled with strong payroll growth in transportation and retail (likely spurred by a ramp up in hiring associated with an inventory build-up ahead of tariffs) accounted for the bulk of growth alongside health care & social assistance.

We saw fewer job losses in the federal government this month after federal layoffs slowed in response to the OPM announcement in early March that essentially paused the government-wide probationary layoffs by shifting responsibility to individual agencies. While the unemployment rate rose, this was largely reflective of an increase in new entrants rather than layoffs.

Looking ahead, uncertainty around tariffs will likely weigh on payroll growth. If this week’s tariff announcements stick, weaker demand for exports will likely weigh on goods-sector hiring.

A thorn in the Fed’s side: What could tariffs mean for U.S. inflation and growth?

Published April 3, 2025

Should the sweeping “reciprocal” tariffs announced by President Trump stay in place in the coming months, our expectation is to see significant upward pressure in inflation and negative shocks to growth.

Roughly 10% of U.S. consumption is accounted for by goods and services imported from abroad. Considering the extent of sweeping tariffs, it will be relatively difficult for consumers to substitute away from imported goods in the near term. For example, U.S. technology in many cases requires chips from Asia and most textile factories are found beyond U.S. borders.

We have elaborated on how 25% tariffs will impact the price of new cars here – but outside of the auto sector, “reciprocal” tariffs will show up in household furnishings (including Scandinavian furniture), recreation commodities (including children’s toys largely from Asia), and medical supplies from Europe among others.

We expect to see a spike in core goods inflation as early as May. This would result in a notable increase in both core and headline inflation. Relative to our baseline forecast (prior to the announcement we had core inflation ending the year at 2.7% y/y), we have modeled two likely tariff risk scenarios:

- 10% tariffs across the board with 25% tariffs on autos and 20% steel and aluminum (*includes USMCA exemptions)

- 20% tariffs across the board with 25% tariffs on autos and 20% steel and aluminum (*includes USMCA exemptions)

Click here to read more about these scenarios and access the full report outlining how tariffs could impact inflation’s path and weigh on U.S. growth.

Are services immune to tariffs in the trade war?

Published April 3, 2025

More attention is being focused on how Canada can better diversify trade to alternative sources as U.S. tariffs and threats continue to escalate. In the goods trade, Canada’s geographical proximity to the U.S. makes it difficult to diversify away from the U.S. But, that is much less of a constraint for services.

In this episode of the 10-Minute Take, economists Claire Fan and Carrie Freestone dig into:

- How much services Canada trades and with who?

- Is Canada well positioned to leverage services for broader trade diversification?

- What are the headwinds facing services amid the ongoing trade war?

Listen to the episode.

Trump’s “Liberation Day”: What comes next

Published April 3, 2025

Starting April 5th, the U.S. is imposing 10% baseline tariffs, with most countries facing a tariff rate that appears to be based on a calculation of trade deficits as a share of exports from that country. Crucially, it exempts Canada and Mexico as it’s not applied to USMCA-compliant products.

Here is the first of six key impacts we’re watching out for next:

1. Canada lives to fight another day, but not without some pain.

Existing tariffs remain, including those based on IEEPA/fentanyl, steel and aluminum and auto and auto-parts that went into effect just past midnight today. Duty-free trade still applies to products that are USMCA compliant—perhaps a signal that the President still takes the agreement he signed seriously.

- Most, if not all, Canadian auto manufacturers have 50% U.S. content, which means an effective tariff rate of 12.5%. Combined with a 70-cent Canadian dollar, it puts Canadian auto and parts makers in relatively good stead, especially in comparison to Asian and European automakers facing up to 25% in tariffs.

- The story on energy is similarly that of relief—RBC Capital Markets highlighted how most, if not all, oilsands producers are USMCA compliant, and not be subject to the 10% tariff on energy. A 10% tariff on other resource products and potash, although significant, is not enough to affect producers’ bottom lines.

- While we may see specific provinces and sectors negotiating for exemptions, most will likely not want to rock the boat until the federal election is over on April 28, and an economic and security partnershipcan be negotiated. But Canada isn’t out of the woods yet—lumber is still in the U.S. administration’s crosshairs, and President Donald Trump alluded to a longstanding irritant of his in Canadian dairy.

Read the full report covering tariffs/taxes, China, trade negotiations, supply chains and more.

Canada emerges relatively unscathed

Published April 3, 2025

Canada emerged relatively unscathed in the U.S.’s latest tariffs – for now.

President Donald Trump announced 10% baseline tariffs on all imports and higher rates on nations that had “looted” the U.S. Canada and Mexico were excluded from the reciprocal tariff regime, but levies on autos, steel and aluminum remain in place.

Prime Minister Mark Carney said he will consult with several stakeholders, including premiers, before responding with “purpose and with force." Global stocks fell, but the loonie was up in after-hours trading. For more, read RBC Thought Leadership’s analysis here.

U.S. Senate blocks Trump’s tariffs on Canada. Four Republicans joined all 47 Democrats in the Senate to vote 51-48 on a resolution to end the state of emergency that allowed Donald Trump's administration to unilaterally impose tariffs on Canadian goods. The vote is largely symbolic as it's unlikely to pass the Republican-controlled House of Representatives.

Republican Senator Rand Paul, a staunch supporter of free markets who co-sponsored the bill, said tariffs in general are a "terrible mistake," noting that the declaration at the northern border was "not a real emergency."

Assessing tariff impacts on healthcare

Published April 3, 2025

- Biotech tariffs (biotech research team) “President Trump's executive order issued this evening lists pharmaceuticals (in addition to copper, semiconductors, and lumber articles) as goods that will not be subject to the Reciprocal Tariff. While this may be read positively, we note that

(1) Pharmaceutical tariffs could still be implemented in the future - and indeed, we thought that many had expected an announcement specific to pharmaceutical tariffs to be announced later, and/or to be phased in rather than immediate

(2) The order calls out the need to maintain "robust and resilient domestic manufacturing" in sectors like pharmaceuticals, suggesting this remains on the administration's radar for the future

(3) The impact of tariffs on the U.S. biotech sector was likely to be relatively modest and manageable, assuming the transfer price on import reflected drugs' cost of goods which are typically very small, though may have been greater for companies with IP domiciled ex-U.S. that kept taxes low.

We continue to monitor but see the ongoing developments at FDA as more material for the space than tariffs.”

- Medtech tariffs (Shagun Singh) “Overall, we believe the broad implementation of tariffs is an incremental headwind for most companies in our universe except those that are U.S. based or exempt. We maintain a positive outlook on the sector with positioning based on relative exposure and companies' ability to offset tariffs to some extent. Net-net, we see more opportunities in the sector and underlying fundamentals are robust.”

- Life Science Tools & Diagnostics (Conor McNamara): “We believe the sector will only feel a modest impact and will look toward Q1'25 earnings calls for more clarity on tariffs and how well these companies can manage. In the meantime, we analyzed company filings, and it appears that over a dozen of our companies are 'net exporters' from the U.S., meaning they have a higher percentage of manufacturing facility assets in the U.S. than domestic revenue. And though these tariffs are likely to impact overall customer demand, perhaps delaying end-market recovery in the sector – expected for 2H 2025 – it could provide a competitive advantage for nearly all of our companies that compete with foreign based entities selling in the U.S.”

Gold strategy: Liberation Day quick take

Published April 3, 2025

Despite the initial move lower from high prices and extended long positioning, we suspect that the cocktail of uncertainty, and growth-negative/inflation-positive implications will support gold. Bullion’s exclusion from tariffs should end the arb trade.

- Given extended long positioning and all-time high prices, macro questions and a near-term shift in gold thinking may have meant the initial move was lower for gold.

- Whatever floor it settles upon, we think will be a building point over the medium and longer term, as we think the net effect of “Liberation Day” will be supportive given the ongoing uncertainty and growth-negative/inflation- positive implications.

- While the 10% minimum baseline tariff could have been a bit of a tariff clearing event on its own, reciprocal tariffs for major trading partners are high and uncertainty certainly lingers ahead of retaliation, responses, etc.

To access the full report, contact your RBC representative.

Natural gas strategy: Liberation Day quick take

Published April 3, 2025

With natural gas in Annex II and not subject to ad valorem rates and USMCA compliant natural gas not subject to the 10% carveout rate, it was a bit of a tariff clearing event for gas. Yet, we do eye economic impact and retaliation risks.

- With natural gas included in Annex II list of exempted goods and thus not subject to the ad valorem rates and USMCA compliant natural gas not even subject to the 10% carveout rate for energy, for now “Liberation Day,” outside of any downside from reduced economic activity and retaliation risks for exports, was a bit of a clearing event.

- Given the uncertainty, shifting nature of the agreement, and eventual of renegotiation of the USMCA itself, we say “for now” it may be liberated from tariffs, and thus natural gas at this point is, in the near term, left to trade on its fundamentals.

- We still think that yet again, natural gas is too high as late season chills have allowed natural gas to hold on to elevated levels with injection season underway. While it’s clear after Q1 that our middle scenario probability has diminished and high scenario has gained steam, we still think natural gas prices have some downside ahead.

To access the full report, contact your RBC representative.

Clean energy tariff implications

Published April 2, 2025

Near-term reciprocal tariffs have mixed implications across the solar landscape. Assuming the tariffs remain for a more significant period of time, we believe they could provide a relative competitive advantage for manufacturers with domestic supply chains. However, near-term the reciprocal tariffs will pressure foreign supply chains broadly and costs across our coverage. While many manufacturers have established significant domestic supply chains, not everything is sourced domestically and will face the impact of tariffs.

To access the full report, contact your RBC representative.

Washington strategy: Moving targets

Published April 1, 2025

- Ahead of tariff ‘Liberation Day’, there is much discussion over the impact of these measures on energy markets. At first glance, the imposition of tariffs would appear to be bearish for oil prices, given the likely contractionary impact for key demand centers such as China. And yet, the White House’s willingness to directly target oil exports through sanctions rebranded as tariffs to punish producers seen as American adversaries poses the opposite price risk.

- Geopolitical uncertainty over the market impact of tariffs and sanctions was one of the overarching themes at last week’s Financial Times Global Commodity Summit in Lausanne. Though multiple speakers noted that the oil market was well supplied, Washington’s move to impose sweeping tariffs and energy sanctions was seen as moving prices outside the range of simple supply and demand models.

- Underlying the angst is the difficulty of determining the ultimate policy priority order for an administration whose policies can appear to be working at cross purposes. Although Secretary of Energy Chris Wright has deep ties with U.S. producers, we suspect the White House may not have the same connectivity with the physical oil trading and market community at this stage.

The report “Washington strategy: Moving targets” was published on April 1, 2025.

To access the full report, contact your RBC representative.

Biotech: Impact on U.S. biotechs of pharmaceutical tariffs could be relatively limited

Published April 1, 2025

Amidst the backdrop of biopharma weakness (XBI down 11% YTD), most recently aggravated by the resignation of Dr. Peter Marks over the weekend, the undefined threat of tariffs levied against the biopharmaceutical industry continues to cast a long shadow.

Relatively little is yet known about these proposed sector-wide tariffs, though additional clarifying details could emerge later this week that better define their scope of implementation. To date, the Trump Administration has suggested several policies - a 25% tariff on pharmaceuticals, and/or policies that would levy reciprocal tariffs to account for any additional subsidies that other governments and tax havens might offer to support certain pharmaceutical companies (though this remains opaque).

In our report, we detail potential implications for the broader sector and individual covered companies. Key questions are what exactly the tariffs would apply to; assuming these would be on the low-cost drug substance being imported, the effects would likely be minimal given generally very high gross margins across the space, though tariffs pegged closer to drugs' list prices and/or designed to offset offshore IP tax advantages could be more impactful. Generally speaking, companies with more ex-U.S. IP and manufacturing would be more exposed.

The report “Biotech: Impact on U.S. biotechs of pharmaceutical tariffs could be relatively limited” was published on April 1, 2025.

To access the full report, contact your RBC representative.

Canada’s main political parties are pitching energy corridors

Published April 1, 2025

Conservative Leader Pierre Poilievre vowed to fast-track approvals of new infrastructure to transport Canadian energy domestically and abroad without going through the U.S.

Prime Minister and Liberal leader Mark Carney is also eyeing a regulatory reboot to speed up energy infrastructure development.

The Conservatives also promised to defer capital gains taxes if the proceeds are reinvested in Canada. With nearly a month to go, the Conservatives are trailing the Liberals and the NDP is on track for one of its worst election results.

Tracking the global consumer on tariffs

Published April 1, 2025

Given mounting investor concern regarding a weakening consumer and the implications of tariffs, our global consumer and retail research team summarized their latest thoughts on the consumer, using hard data points from our various coverage universes.

On tariffs, we generally believe that companies operating in and around the US and Canada have the highest potential to be adversely impacted. Uncertainty around the tariff situation has likely led to hesitation across the supply chain, from the consumer to the retailer and the supplier. Anxiety from the consumer has led to a recent sharp dip in consumer confidence and sentiment.

Methods to mitigate the impact of current and potential tariffs are wide-ranging. These include, but are not limited to, sharing incremental costs with suppliers, further diversifying supply chains and sourcing, shifting manufacturing locations, raising prices, and leaning into productivity. We see particular hardship for products that have certain appellations, or legally defined geographic origin and quality (e.g., Champagne, Scotch Whisky, Irish Whisky, Cognac, Tequila), or marketing provenance as shifting manufacturing is nearly impossible.

On the contrary, additional U.S. tariffs on China may free up manufacturing capacity to serve European retailers and put further downward pressure on shipping rates, thus providing a cost tailwind.

Contact your RBC representative to access the full report, including commentary on U.S. consumer staples, hardlines/broadlines, food retail & e-commerce, restaurants and leisure facilities, the Canadian consumer, and European consumer staples and general retailing.

Five ramifications of U.S. auto tariffs

Published March 28, 2025

On Wednesday March 27th, President Trump announced a 25% tariff on imports of automobiles and parts. Importers are set to face tariffs on all non-U.S. import content effective April 3rd. This announcement will have wide-ranging ramifications due to the multi-layered supply chain linkages of the North American auto sector.

Ahead of the implementation next week, we sought to spell out the potential impact of these tariffs to the U.S. auto sector. Here are five ways that the auto tariffs will impact the U.S. automotive sector and broader U.S. economy:

- Tariffs could result in a near-term boost to growth from an inventory build-up

- Tariffs will drive up consumer prices for new and used autos

- Consumers may shift towards purchasing used autos

- Auto loan delinquency rates could rise

- Weaker demand for vehicles could drive layoffs in the sector

Frances Donald on CNBC

Published March 28, 2025

Frances Donald, Chief Economist, RBC, and CNBC’s Steve Liesman join ‘The Exchange’ to discuss where the economy is heading, their take on the latest inflation data, and more.

Click here to watch Frances in action.

Food Fight: China’s tariffs adds to exporters’ woes

Published March 27, 2025

China retaliated with tariffs of its own on various Canadian agricultural exports in response to Ottawa’s tariffs last fall on Chinese electric vehicles and metals.

While the new tariffs—100% on Canadian exports of canola oil, canola oil-cake, and pea imports, and 25% duties on pork and aquatic products – are expected to impact a small share of total Canadian domestic exports, some industries and provinces may face more significant challenges than others.

The new tariffs mark an escalation in trade tensions between Canada and China, with the risk tilted to the upside. It comes as the agriculture sector is already experiencing challenges posed by the trade uncertainty with the United States.

Macro Minutes podcast: Butterfly effect

Published March 26, 2025

Participants on this episode:

- Jason Daw (Desk Strategy), Head of North America Rates Strategy

- Peter Schaffrik (Desk Strategy), Head of UK & European Rates and Economics

- Su-Lin Ong (Research), Chief Australia Economist

Below is a summary of their discussion.

Click here to listen to the full podcast.

In the latest edition of Macro Minutes, recorded on March 26, 2025, the discussion centered on the butterfly effect of U.S. trade policies and their broad impact on international fiscal policies, politics, and potentially monetary policy and the bond market. The episode highlighted how even minor tweaks in trade strategies can send shockwaves through the global economy, prompting shifts in political dynamics and financial strategies in various countries. Expert guests provided insights into the repercussions of these policies, emphasizing the interconnectedness of global economic systems and the importance of considering far-reaching consequences when formulating trade agreements.

Eye on U.S. reciprocal tariffs ahead of key job market reports

Published March 26, 2025

The United States’ administration’s announcement on reciprocal tariffs on Wednesday threatens to overshadow normally key job market reports for February in Canada and the U.S. on Friday.

The start and stop of trade threats and actions from the U.S. have been dizzying, but as much as the uncertainty has intensified, U.S. tariffs implemented so far have not been large enough to cause a recession in Canada. By our count, the effective average U.S. tariff on imports from Canada has increased to about 2.5% from essentially zero in January.

The vast majority of U.S. imports from Canada that are USMCA/CUSMA compliant were quickly exempted from the more severe blanket 25% tariff imposed in early March. The additional steel and aluminum tariffs implemented on March 12 are large, but products impacted account for a relatively small share (about 4%) of Canadian exports to the U.S.

Assessing the impact of tariffs and trade wars on software

Published March 27, 2025

In an excerpt from the research report, “Assessing the Impact of Tariffs and Trade Wars on Software,” Rishi Jaluria, Software Analyst, outlines a framework to evaluate the potential impacts of tariffs on the software sector and which categories may be most affected.

Tariffs and trade wars create uncertainty.

- Anything that creates uncertainty is bad, especially for projects that have longer payback periods, are expensive, or are more discretionary.

- We would advise investors to dust off their playbooks from the early days of COVID, which led to longer sales cycles, deprioritization of projects, and smaller deal sizes.

Software should be relatively tariff-proof… but the end customers may not be.

- Software and services are difficult to apply tariffs to, so we don’t expect any real direct impact on the software companies or business models. But their customers may not be tariff-proof and that could have follow-on impacts on software companies more heavily exposed to those industries.

- Generally, any industry with a global supply chain would be at risk (i.e., manufacturing, aerospace, consumer products and electronics, semiconductors, energy), and many of those companies may focus more on their supply chain or tariffs leading to deprioritization of certain software projects.

What if tariffs cause a recession?

- While too early to make the call, if tariffs and trade wars trigger or contribute to a recession (similar to the Smoot-Hawley Tariff Act of 1930), then we need an entirely new playbook for software investing.

To access the full report, contact your RBC representative.

European Markets with Peter Schaffrik: Germany's fiscal boost and tariff tensions

Published March 24, 2025

In this edition of European Markets, Peter Schaffrik, Chief European Macro Strategist, discusses the increase in fiscal spend that is likely to come out of Germany and Europe at large, and how it balances against the potential tariffs and obviously what it means for the economy and the market.

Predictions for a volatile geopolitical year ahead

Published March 24, 2025

In this episode of Strategic Alternatives, Helima Croft, Head of Global Commodity Strategy and MENA Research and Frances Donald, Chief Economist sit down with Fred Kempe, President and CEO of The Atlantic Council to discuss the top risks and potential outcomes on global trade and tariffs, implications for energy markets, Russia-Ukraine negotiations, intervention in the Middle East, and more.

How the Fed is navigating inflation, tariffs, and economic uncertainty

Published March 18, 2025

Blake Gwinn, Head of U.S. Rates Strategy, joins the Bond Buyer podcast to discuss factors influencing the Fed’s decision making, outlook for interest rates, current economic environment, tariffs, and more. Below is a snippet of their conversation:

Gary Siegel (19:42):

It's time to talk about tariffs. Blake, no one knows what's going to happen, but what is your view? How long will they be in place? What impact will they have on the economy or any other version of that question you want to answer.

Blake Gwinn (22:46):

Our view is that if you try to do these kinds of broad tariffs, that there would be court challenges that would essentially curb their ability to put in these broad tariffs. So, I don't think that for all the noise we've had over the last few weeks, I don't think either of those things has necessarily been disproven. I don't think maybe there's a slightly bigger risk now after seeing how aggressively they've gone after it after trade in the early days, maybe that increases the odds of a bad outcome a little bit more. But if anything, I can look at the pullback that we've seen and with the Canada where we've seen the rolling out of deadlines, we've seen the pullback in USMCA compliant categories, et cetera. It does seem like the pushback, and so I'm still relatively sanguine, again with very, very low conviction, with very low conviction that there's going to be a lasting large, broad type of tariff that we were expecting.

Click here to listen to the episode.

March George Davis Report: Revisiting our tariff scenarios

Published March 17, 2025

The George Davis Report is a monthly series on the movement of the Canadian dollar produced by RBC Capital Markets. This month, George revisits RBC’s tariff scenarios and discusses the Bank of Canada’s response.

Click here to watch the full video.

In this month’s edition of the George Davis Report, George explores the effects of the ongoing trade tensions and the recent Bank of Canada interest rate decision on the USD/CAD currency pair. The market has been wrestling with tariff-related uncertainties, which have led to a sticky resistance at the 1.4550 level, preventing a daily close above this threshold. Despite this, the risks are still skewed to the topside, with potential fluctuations within a 1.4600 to 1.4800 trading range, depending on the duration of the imposed tariffs. He also observes that the recent increase in long U.S. dollar CAD positions reflects the market's anticipation of a tariff premium, suggesting that as long as tariff risks loom, an upward pressure on the currency pair may persist.

Further complicating the currency outlook, George discusses the Bank of Canada's recent policy action, where a 25-basis point rate cut was implemented as a precautionary measure against tariff-induced economic risks. Although recent economic indicators have been robust, the softer survey data hint at potential headwinds, leading to the preemptive rate cut. However, the Bank of Canada has highlighted that monetary policy alone isn't sufficient to counteract tariff challenges, underlining the importance of a fiscal response. With the government's initial fiscal measures and the possibility of more stimulus in response to prolonged tariffs, he suggests that the expectation for further rate cuts may be tempered, which is an important factor to monitor for its potential impact on the Canadian dollar.

Metal wars: Five things to watch for as U.S. steel and aluminum tariffs roll out

Published March 12, 2025

The U.S.-Canada trade war has kicked off, with Canadian steel and aluminum exports, valued at $24 billion annually, set to be tariffed at 25% starting on May 12th. We highlight five themes to watch for as the two economies brace for the fallout from these levies:

- The tariffs are unlikely to reinvigorate U.S. production

- The devil is in the details on China’s access to U.S.

- For all the China talk, Canada has become target number one

- Exemptions for Canada will be hard to come by

- The best chance for success is to offer concessions

It's a new dawn (day), and no one’s feeling good: Tariffs slash growth momentum in Canada and U.S.

Published March 12, 2025

Trade risks are set to wipe out early signs of economic recovery in Canada—we expect gross domestic product growth to slow and the unemployment rate to edge higher in coming quarters.

The U.S. economy’s run of exceptional performance is also facing headwinds from trade disruptions, government spending cuts, and lower immigration rates.

Central bank paths going forward are little changed from last month. The Bank of Canada will continue to cut interest rates, but we don’t expect a race to the bottom, pending fiscal supports.

Issue in focus: We look at how the value added tax (VAT), like Canada’s GST, is being tied to possible U.S. tariff plans as the planned April 2 announcement of reciprocal U.S. tariffs threatened on all trade partners approaches, and what it could mean for Canada and others.

In the media: Oil outlook and U.S. banks

Published March 11, 2025

- Helima Croft, Head of Global Commodity Strategy and MENA Research joins BNN Bloomberg to discuss the outlook on oil amid tariff policy uncertainty, impact of geopolitical headlines on energy markets, and more.

- Click here to watch Helima in action.

- Gerard Cassidy, Global Co-Head of Financials Research and Head of U.S. Bank Strategy, joins Bloomberg: Surveillance to discuss tariff policy uncertainty and the impact on bank stocks, M&A activity, and more.

- Click here to watch Gerard in action (1:51:46).

Tariff takeaways from the 2025 Financial Institutions Conference

Published March 10, 2025

Regulatory and Trade Uncertainty Remains a Challenge

As we entered 2025, the economic landscape remained complex, shaped by macro trends, regulatory shifts, and geopolitical uncertainty. While the U.S. economy continued to show resilience with moderate GDP growth and a robust labor market, new risks have emerged that are influencing financial institutions’ strategies.

The conference took place just as the administration imposed new tariffs on Canada, Mexico, and China, disrupting markets and adding uncertainty to global capital flows and corporate investment. The policy volatility is already pressuring businesses, with higher import costs, declining consumer confidence, and rising inflation expectations.

Regulatory shifts are also in focus. The Basel III Endgame proposal, which initially called for significant capital increases on large banks, is being reconsidered, potentially easing constraints on lending and M&A activity.

Trade Policy and Market Volatility

The impact of shifting trade policies was a dominant theme, with business leaders highlighting the uncertainty caused by tariffs and isolationist policies. These changes have led to corporate hesitation around M&A, capital investment, and supply chain restructuring, as companies struggle to make long-term decisions in an unpredictable regulatory environment. Rising inflation concerns were also top of mind, with some warning that labor shortages, supply chain disruptions, and geopolitical tensions could keep inflation elevated longer than expected.

Click here to read Vito’s full takeaways from the conference.

RBC Panel on Bloomberg TV

Published March 7, 2025

Today, there was an RBC “takeover” at Bloomberg Surveillance with two panels featuring our experts on the economy, FX, U.S. equity markets and equity derivatives. Their discussion focused on Trump’s economic agenda, how FX will impact U.S. tariffs and how inflationary they are, volatility amid tariff policy uncertainty, market reaction with stocks poised for the worst week of the year, and more.

Click here to watch the full show | Frances & Elsa at 30:30, Lori & Amy at 1:19:58.

RBC participants:

- Frances Donald, Chief Economist, RBC

- Elsa Lignos, Global Head FX Strategy

- Lori Calvasina, Head of U.S. Equity Strategy

- Amy Wu Silverman, Head of Equity Derivatives Strategy

In the media: U.S. Rates strategy, U.S. equities and consumer prices

Published March 7, 2025

- Blake Gwinn, Head of U.S. Rates Strategy, joins Yahoo Finance: Morning Brief to discuss the impact of February jobs data on the bond market, economic uncertainty amid potential tariffs, and more.

- Click here to watch Blake in action.

- Lori Calvasina, Head of U.S. Equity Strategy, joins CNBC: Fast Money to discuss the impact of the falling dollar on markets, investor sentiment around the disruption coming out of Washington, tariffs beyond negotiation tactics, and more.

- Nik Modi, Co-Head of Global Consumer and Retail Research, joins Bloomberg Markets: The Close to discuss Brown-Forman beating Q3 estimates, what drove performance and impact of tariffs on alcohol companies.

- Click here to watch Nik in action (18:20)

What is the impact of tariffs on the U.S. economy?

Published March 5, 2025

The effective U.S. tariff rate is now 12%. That’s the highest level since the 1940s after U.S. President Donald Trump slapped tariffs on Canada, Mexico and China. What is the impact of these tariffs on the U.S. economy? RBC Economics' Michael Reid and Carrie Freestone answer nine questions we’re getting asked about what this means for the U.S which include:

- How important is U.S. trade with Canada, Mexico, and China?

- Will there be a recession and how will this impact U.S. growth?

- Which sectors will be hit the hardest?

- How easy is it for the U.S. to “reshore” the most impacted sectors?

- How might tariffs show up in U.S. inflation measures?

- How will tariffs impact U.S. consumers?

- How much revenue could tariffs generate for the U.S.?

- How easy or difficult is it to substitute away from tariffed imports?

- How might the U.S. Federal Reserve respond?

RBC’s McKay warns of hit to economic growth from U.S. tariffs

Published March 4, 2025

Featured in an article in Bloomberg, Dave McKay said he’s hopeful U.S. tariffs end up being temporary but that it’s disappointing to see the trade war started by U.S. President Donald Trump potentially impeding broader economic growth.

“It’s a little frustrating to see the loss on momentum,” the chief executive officer of Canada’s largest bank told investors Tuesday morning at the Global Financial Institutions Conference in New York. “We still hope for the best outcome that these tariffs are short-lived, and we get back onto a growth agenda on all sides of the border that we were on before.”

Watch the livestream of the interview here.

U.S. tariffs on Canada take effect: What is the state of play

Published March 4, 2025

The U.S. administration has implemented blanket tariffs on Canada and Mexico after a 30-day reprieve with 25% on all imports except 10% on Canadian energy. An additional 10% tariff on China is also planned.

Canada has been hit with its largest trade shock in nearly 100 years and responded promptly with 25% tariffs on $30 billion of U.S. goods, rising to $155 billion in 21 days. Evolving trade policies and government responses still remain highly uncertain as we highlighted in our first economic takeaways a month ago.

But, as we assess the implications of the implementation of tariffs on our forecasts—to be released in our monthly Financial Markets Monthly next week—here is a cheat sheet summary of what we know and are incorporating into our outlook.

Click here for the full report.

In the media: Dave McKay on tariffs, U.S. and Canada trade relations

Published March 4, 2025

David McKay, RBC president and CEO, joins ‘Squawk Box’ to discuss the fallout from Trump’s new tariffs, impact on U.S.-Canada trade relations, and more.

McKay underscores the importance of the longstanding trade partnership between Canada and the U.S., advocating for maintaining consistent trade agreements and emphasizes Canada's role in supplying resources to the U.S. and the potential impacts of U.S. isolationism on the successful history of multilateral partnerships.

Getting critical on critical minerals: The five to watch

Published March 3, 2025

As the world races to secure the critical minerals essential to a modern economy, Canada has a crucial decision to make: what role can it play in de-risking a critical mineral supply chain that is overwhelmingly dominated by China?

At PDAC 2025, this question is top of mind for industry leaders, policymakers, and global investors. Building on our Getting Critical on Critical Minerals briefing, we’re diving deeper into five minerals increasingly vital to the economy of the future.

Each of these minerals are vital inputs across five key focus areas: artificial intelligence, border security, healthcare, energy, and defense. But supply chains are vulnerable, international competition is fierce, and Canada must navigate complex policy, investment, and processing challenges to establish itself as a global leader.

Explore the briefing here.

In the media: Economy and auto industry

Published February 28, 2025

- Frances Donald, Chief Economist, joins Bloomberg: Surveillance TV and Radio to discuss PCE reactions, outlook for U.S. economic growth, Canada and U.S. import and trade relations, and more.

- Tom Narayan, Global Autos Analyst, joins Bloomberg: Surveillance TV to discuss the impact of potential tariffs on the auto industry.

- Click here to watch Tom in action.

- Michael Reid, U.S. Economist, joined Yahoo! Finance to discuss the upcoming tariffs for Canada, Mexico and China set to be implemented, what these events mean for the broader economy, how this could impact consumer spending, and more.

- Click here to watch Michael in action.

- Lori Calvasina, Head of U.S. Equity Strategy, joins Bloomberg: Surveillance TV and Radio to provide her updated thoughts on the impact of tariffs on global equities, sentiment shock across the market, outlook amid uncertain U.S. growth, and more.

Geopolitics: Inside track on tariffs

Published February 27, 2025

With the details of the White House’s looming tariffs on Canada and Mexico outstanding, we highlight the singular importance of Deputy Chief of Staff Stephen Miller in the Trump administration policy process. Miller essentially oversees the policy agenda for the White House and, along with Trade Advisor Peter Navarro, is reportedly helping to shape US trade policies. As we have noted, President Trump’s advisors have made it clear that he would break from past precedents on the use of tariffs. Rather than seeking to rectify trade imbalances, the second Trump administration would use tariffs to achieve pressing foreign policy goals and essentially operate as de facto sanctions. Miller has had notable staying power, joining the Trump campaign in 2016 and serving as a top aide and speech writer for the President, including in his four years out of office. He has been seen by many as the architect of the flood-the-zone policy blitzkrieg in the first month of the new administration, taking a step back from his traditional speechwriting role to focus on the execution and implementation of Trump policy.

Immigration has been of particular importance for Miller throughout his career, including while he was an aide to Senator Jeff Sessions, and has emerged as a key tool for rallying support for White House policies on the Hill. Navarro, another key voice returning to the White House from the first term, was seen as leading the push for early executive action on tariffs. Navarro was instrumental in the first-term China tariffs and has insisted this month that the tariffs on Canada and Mexico serve a dual purpose, namely to compel action from the respective governments on immigration and illicit drug trade. To that end, as market participants weigh the impacts of tariffs for energy, we reiterate that demonstrable policy changes from the US neighbors may be more material than trade balances for key players in the White House.

To access the full report, contact your RBC representative.

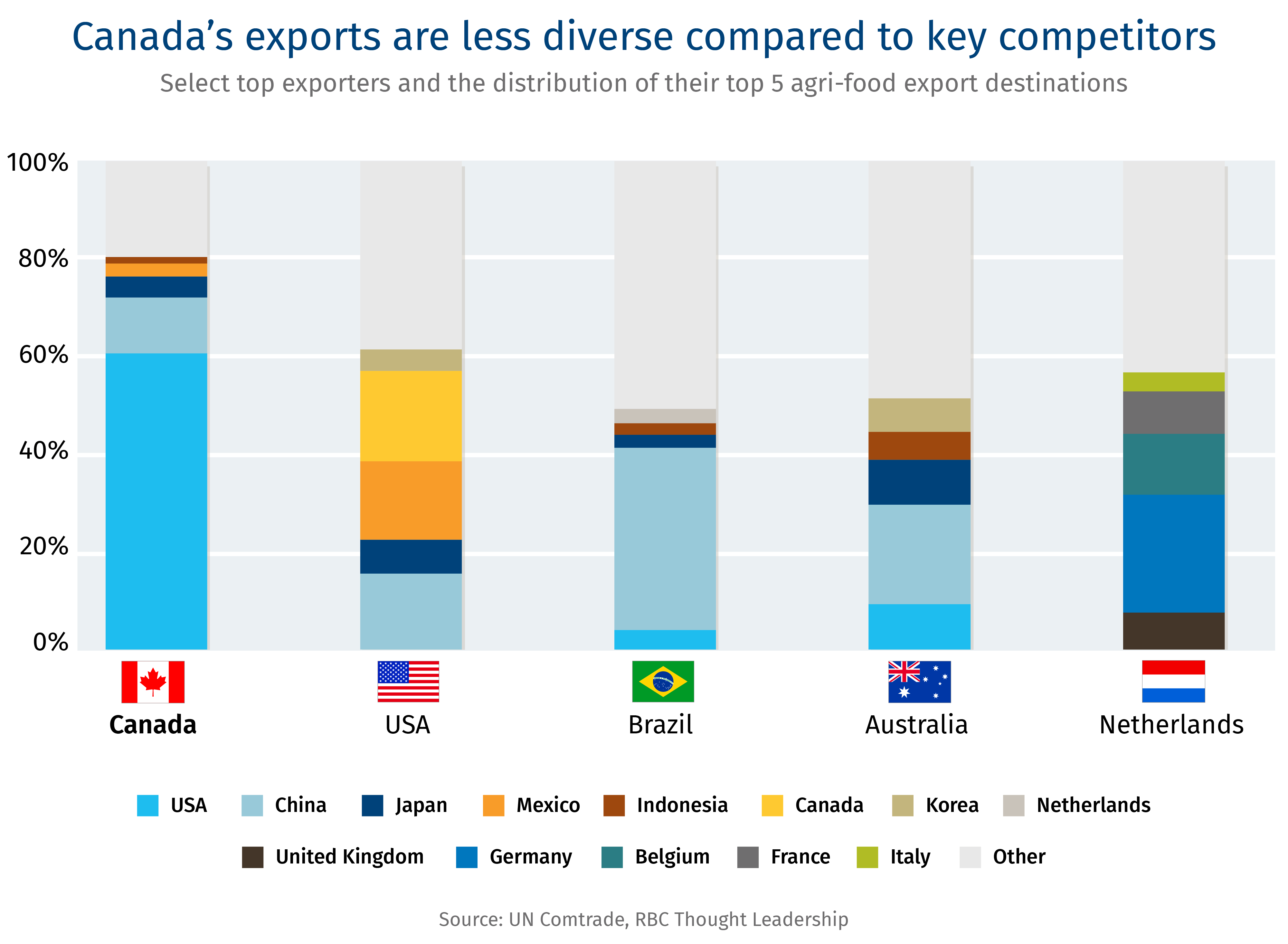

Food first: How agriculture can lead a new era for Canadian exports

Published February 25, 2025

More than $100 billion worth of agriculture and agri-food products cross the border every year, with the U.S. importing nearly 60% of this trade. And thanks to a surge in agri-food processing investment over the last 20 years, that trade gap is growing. The value of Canadian exports to the U.S. has quadrupled since 2000, and Canada is now the source of 20% of U.S. agriculture and agri-food imports.2

These advantages are now in question with the threat of large-scale tariffs. If they’re applied to agriculture and agri-food products, they will make Canada a less desirable trade partner to the U.S., as our position as a low-cost exporter of agriculture and agri-food products relative to others, including China and the Netherlands, will suffer. Agri-food manufacturing may also struggle to maintain investment levels, as one of its biggest selling features has been its preferential access to the world’s largest market.

Such challenges will force Canadian producers to make a choice: accept the cost of tariffs to access the U.S. market, or search for more demand abroad.

Click here to access the full article on the Trade Hub.

Six questions about the significance of interprovincial trade barriers in Canada

Published February 25, 2025

We address some of the questions RBC Economics has been receiving about interprovincial trade barriers—what they are, how much they cost the economy, and whether they can be effectively reduced. The questions are as listed below:

- What are interprovincial trade barriers?

- How costly are internal trade barriers?

- How would reducing internal trade barriers improve the economy?

- Would eliminating interprovincial trade barriers compensate for a significant loss of access to the U.S. market?

- Which provinces and sectors would benefit the most?

- How could trade barriers be reduced?

To get the answers on these questions, read the full article on the Trade Hub.

Uncertainty, policy, tariffs, and FX remain in focus on this past week’s earnings calls

Published February 18, 2025

The theme of optimism being eclipsed by uncertainty that we’ve been highlighting over the last few weeks persisted. In terms of optimism, strong demand/orders, M&A, economic resilience, and IT budgets were cited. Risks highlighted included currency, geopolitics, tariffs and trade, energy, and monetary policy. One bellwether Industrial company noted demand had been constrained by uncertainty. Meanwhile, a Tech company noted that they had seen some evidence of caution having an impact on customer behavior (though it had not yet translated into spending pulling back). As reporting season winds down, we find ourselves thinking that it may be 1Q25 reporting season before we get good color on how policy uncertainty is affecting current business conditions.

On policy, companies highlighted the uncertainties emanating generally and on trade, M&A regulations, food regulations, and SNAP benefits in particular. On DOGE, several companies highlighted the opportunity associated with a renewed focus on government efficiency.

Tariffs were once again in focus, and commentary highlighted the fluid and uncertain nature of the current situation and references to mitigation plans and possible supply chain readjustments. Some companies that discussed the topic last have the announced tariffs baked into guidance, while others do not, and as reporting season winds down we see further downside risk to S&P 500 EPS from tariffs.

February George Davis Report: The fog of tariffs

Published February 14, 2025

The George Davis Report is a monthly series on the movement of the Canadian dollar produced by RBC Capital Markets. This month George discusses risks associated with U.S. trade tariffs.

Click here to watch the full video.

In the recent video, George Davis discusses various scenarios that could influence the potential impact of U.S. tariffs on the Canadian dollar. The most severe scenario involves immediate implementation of 25% tariffs on all goods from Canada, which could result in dollar Canada potentially exceeding the 1.5000 level due to the inflationary shock in the U.S. and negative implications for the Canadian economy. A more moderate scenario with immediate 25% tariffs but exclusions for certain industries, such as a lower tariff on crude oil, could see dollar Canada reaching between 1.4800 to 1.5000. This aligns with market reactions observed before the early February deadline when dollar Canada peaked at 1.4793 before retreating.

Another scenario posits a delayed implementation of 25% tariffs on all Canadian goods, which might cause a temporary spike in dollar Canada to levels seen during COVID and in 2016, around 1.47, followed by a decrease to the 1.4400-1.4500 range. This fluctuation is anticipated due to initial reactions leading to negotiations and the hope of reaching an agreement to prevent full tariff implementation, thereby mitigating the impact on the Canadian economy and its currency. The report also notes that continuous changes in monetary policy, including expected rate cuts by the Bank of Canada and stable rates from the Fed, could limit the Canadian dollar's depreciation to around the 1.4000 mark. Given the uncertainty and lack of concrete details on the tariff specifics, the advised trading range for the upcoming month has been adjusted to 1.4100 to 1.4600, with the anticipation of volatility in response to tariff-related news.

U.S. administration to consider reciprocal tariffs

Published February 14, 2025

President Trump signed a measure directing the U.S. trade representative and commerce secretary to propose new levies on a country-by-country basis to rebalance trade. Howard Lutnick, Trump’s nominee for the Commerce Department, said studies should be complete by April 1 and Trump could act immediately after. Trump said "I will charge a reciprocal tariff, meaning whatever countries charge" the U.S. The move came before he was set to host Indian Prime Minister Narendra Modi, whose country has high tariff barriers.

European Markets with Peter Schaffrik – Tariff update

Published February 13, 2025

In this month’s episode of European Markets, Peter is joined by Jason Daw, RBC’s Head of North America Rates Strategy, to discuss the subject on everyone’s lips: tariffs. They look at the potential impact of the tariffs using the example of Canada and whether there are any learnings and/or implications for European economies.

Reorienting Canada’s economy in a changing world

Published February 12, 2025

The latest tensions with the U.S. should jolt Canadians into seeking an economic and trade reboot. While relations with Washington may recover, the scars should be a reminder that Canada must remain agile in a world of shifting alliances.

That does not mean moving away from the U.S.; a strong Canadian-American partnership is a source of strength for both economies. But it’s prudent for Canada to seek more allies, trade partners and customers across the Atlantic and Pacific.

Trade Hub, a new digital platform, aims to highlight opportunities for Canada in this new economic order. In this effort, we will examine several key areas where Canada can leverage our strengths, including agriculture, energy, critical minerals and manufacturing supply chains, and the regulations and policies that drive investments into the country.

Click here to access the full article on the Trade Hub.

President Trump to impose 25% tariffs on all steel and aluminum imports

Published February 10, 2025

The U.S. president said he would apply tariffs on Monday and announce "reciprocal" tariffs on countries that impose tariffs on U.S. goods likely within a couple of days. Canada is the largest supplier of both metals to the U.S. It comes a week after Trump paused plans to put 25% tariffs on imports from Canada and Mexico. He put 25% tariffs on steel and 10% on aluminum from Canada during his first presidency but lifted it a year later.

Central banks in a turbulent economic landscape

Published February 10, 2025

In the latest edition of Macro Minutes, recorded on February 4, 2025, RBC Capital Markets' macro and market strategists delve into the significant market developments that unfolded over the weekend and at the start of the trading week. The discourse was primarily driven by President Trump's announcement of tariffs on Canada, Mexico, and China, with subsequent postponements for Mexico and Canada, while signaling potential tariff impositions on the EU. The episode provides an in-depth analysis of central bank activities in light of these tariff announcements, as well as insights into the non-tariff fundamentals that are influencing policy decisions. The strategists discuss the Federal Reserve's recent halt in its rate reduction cycle, the Bank of Canada (BoC) and the European Central Bank (ECB)'s respective 25 basis point cuts, and the market's expectation for the Bank of England (BoE) to potentially follow suit later in the week.

Five things we learned this week about U.S.-Canada trade

Published February 7, 2025

North America has seen a “reprieve” this week in what could have been one of the largest trade shocks in 100 years—25% tariffs imposed on Mexico and Canada by the United States that have been delayed by 30 days.

Still, uncertainty persists and hangs over the Canadian economy like an ominous cloud, likely weighing on business activity and consumer confidence. And, even as the list of unknowns remains long, the past week has taught us a few things about what a trade shock could look like for the Canadian economy.

Here are five things we learned this week that are critical for the trade discussion.

- Trade angst isn’t likely to go away anytime soon.

- The Bank of Canada would likely cut interest rates further.

- Canada’s retaliatory strategy would impact growth and inflation.

- Sectors and provinces would be hit differently by proposed tariffs.

- Fiscal strategies suggest both outlays and reforms could be in play.

Read the full article for more in-depth analysis into each of the five key areas that are critical for trade discussion.

Navigating economic challenges: Canada's resilience and opportunities amid U.S. tariffs

Published February 5, 2025

After tariffs were delayed, RBC’s Chief Economist Frances Donald spoke with Ram Amarnath, Co-Head of Global Financial Sponsors and Head of Canadian Diversified Industries at RBC Capital Markets, about the potential impact of 25% tariffs on the Canadian economy and what corporations, investors and policymakers in Canada and the U.S. need to think about in the weeks and months ahead.

Read below for an excerpt from the Strategic Alternatives podcast.

Amarnath: Given tariffs are now delayed, how does that change the way you're thinking about this situation? What do you think we'll see over the next month?

Donald: One of the challenges we hear is that when the first Trump administration put tariffs in place in 2018-2019, there was no inflation, no big catastrophe. In part, that's because the magnitude of those tariffs was so small compared to this 25% across the board.

For example, China is about 15% of U.S. trade but Mexico and Canada are a combined 30%, so you’re tripling the ban on imports heading to the U.S. One measure economists use is the average import tariff for Americans. In 2018, that number rose from 1.5% to 3%, and had these 25% tariffs gone through, that number would've gone up to 11%. That's a quadrupling of tariffs that we did not see in 2018-2019.

It's particularly problematic because it targets a manufacturing base that sees products cross borders up to seven to eight times, meaning tariffs hit multiple times. This is the highest increase in an average ratio that we've seen since 1943, so we narrowly avoided (for now) one of the largest shocks in almost 100 years to the North American trading system.

Still, we did learn some things from 2018-2019 – that currency can offset a little bit of the pain; that behaviour of inventory hoarding; that behaviour of uncertainty and how it flows through. Some even point out that by the end of 2019, we were starting to see manufacturing weaken and some prices coming up, but then COVID wiped the slate clean on a bunch of data. So yes, there are lessons we’re using from 2018, but it's really a quarter of what we would've seen if 25% tariffs were enacted.

In the media: Economy, rates, equity markets and commodities

Published February 4, 2025

Lori Calvasina, Head of U.S. Equity Strategy, joins Bloomberg: Surveillance TV and Radio to provide her reaction to tariffs sparking turmoil across global markets, impact on pricing, a sector review looking at where there is heightened risk, and more.

Click here to watch Lori in action (9:20 and 20:17)

Blake Gwinn, Head of U.S. Rates Strategy, joins Bloomberg Brief to discuss his takeaways on tariffs, why a potential trade war could pose more of a downside-risk to U.S. growth rather than inflation, and more.

Click here to watch Blake in action (29:58)

Frances Donald, Chief Economist, joins Bloomberg: Surveillance TV and Radio, to discuss how tariffs and President Trump’s threat of using them could ripple through the U.S. economy. She also discusses the price of uncertainty, variations of inflations and impacts, and more.

Click here to watch Frances in action (42:50) and listen to her here.

Helima Croft, Global Head of Commodity Strategy, joins CNBC to discuss how oil prices rising despite tariffs that could dampen global demand, uncertainty around further tariff actions and impacts, particularly for OPEC’s production plans.

Click here to watch Helima in action.

A U.S.-Canada trade shock now in play: First economic takeaways

Published February 3, 2025

Canada is facing its largest trade shock in nearly 100 years. While the landscape evolves, RBC Economics is providing insights and clear analysis with the recognition that the evolution of trade policies, and policymakers’ responses to them, remains highly uncertain.

Below are some of the first economic takeaways. Click here to read the full report.

- This is the most significant trade shock since the Smoot-Hawley tariffs of the 1930s, which are widely blamed for exacerbating and prolonging the Great Depression. This far surpasses the 2018 tariffs in magnitude, diminishing the value of that period as a helpful guide for the economic impact ahead.

- A persistent tariff of this magnitude is recessionary for Canada. If sustained, our initial analysis suggests that tariffs of this size (based on many assumptions) could wipe out Canadian growth for up to three years, with the largest impacts in the first and second years.

- Canadian retaliatory measures (25% on $155 billion (CAD), phased in) appear designed to asymmetrically challenge the U.S. economy more than the Canadian economy. However, they will still function like tariffs do for any imposing country – by lowering growth and raising inflation on targeted goods.

- Canada’s manufacturing sector is most exposed, but the knock-on effects will also matter in many other indirectly exposed industries.

- Tariffs are hitting the Canadian economy at a moment during which it is already struggling. Canada is still recovering from a major interest rate shock, and even as the Bank of Canada has cut interest rates by 200bps, the unemployment rate continues to rise, with the country is still operating with excess supply and below full capacity.

- Tariffs will also be damaging to the U.S. economy. While the U.S. economy is starting from a relative place of strength (and is far less reliant on trade), it will face a shock large enough to adjust most forecasts downward on growth and upwards on inflation.

Washington strategy: Tariffs and commodity impact

Published February 2, 2025

Since President Trump’s sweeping electoral victory in November, his advisors made it clear that he would break from past precedents on the use of tariffs. Rather than seeking to rectify trade imbalances, the second Trump administration would use tariffs to achieve pressing foreign policy goals and essentially operate as de facto sanctions. In the Trump World view, a clear benefit of using tariffs versus sanctions is that it does not accelerate the global de- dollarization trend in pursuit of important policy priorities such as curbing cross-border fentanyl flows and migration. Additionally, in our view, the unwinding process for tariffs can be more straightforward than with sanctions, which are often backstopped by or originated in Congress, giving the White House a freer negotiating hand.

While we are not ruling out a relatively swift resolution to the U.S. trade dispute with Canada and Mexico, it is unclear if either have an immediate policy prescription on hand that would result in the unwinding of the 25% tariffs on their U.S.-bound exports, which were imposed under the little-used International Emergency Economic Powers Act (IEEPA). In addition, since this is a nontraditional trade dispute, it is not clear which U.S. officials will have the most sway on the matter. Will Deputy Chief of Staff Stephen Miller and Commerce Secretary pick Howard Lutnick be equally weighted voices, or will the former prove to be the more important principal in this Oval Office conversation, as he already oversees large parts of President Trump’s agenda?

Some key Canadian energy corporates also likely have good lines of communication into the White House through staff members who served in the previous Trump administration. We envision that these individuals will continue to press the case for Canadian energy in Washington. Nonetheless, the broader U.S.-Canada trade standoff looks set to deepen for now even if energy has been granted something of a special situation status, with Ottawa already announcing retaliatory measures on $30 billion worth of U.S. goods.

Finally, China may actually have an easier road ahead than Mexico and Canada. There may have been a determination that the economic cost of a full-blown trade war with Beijing may be too calamitous. In addition, in our meetings in Washington, it was suggested that China may be able to placate President Trump by offering to make a sizable purchase of U.S. goods, including aircraft, soybeans, and natural gas – LNG in particular may feature, given the President’s early actions on LNG approvals and declaring an energy emergency. In return, China might seek to extract a pledge that the U.S. will not intervene in a China-Taiwan confrontation. While such a pledge might rattle some members of Congress, it would potentially align with the increasingly ascendant JD Vance view that the U.S. needs to pare back its overseas military and financial commitments.

To access the full report, contact your RBC representative.

Global oil pricing stress test

Published February 2, 2025

The latest on crude and tariffs:

“Out of all the places that the Trump administration could have shown restraint, Canadian energy was likely the optimal choice. Looking at the potential profitability impact scenarios, a 25% tariff on energy imports would have likely been enough pressure on profitability that physical disruption would have been highly likely.

At 10%, pricing offsets are more manageable, and likely will not require a significant overhaul to physical flows… While we should start to see seasonal upside pressure for gasoline prices, incremental upside from energy tariffs alone is likely ~$0.15/gal.”

To access the full report, contact your RBC representative.

Natural gas quick take: Tariff impact

Published February 2, 2025

The 10% tariff on energy is still disruptive (versus 25%) to the highly integrated natural gas market in North America, where the U.S. is both a vital supplier and consumer of natural gas via a highly integrated pipeline system between the U.S., Canada, and Mexico. The U.S. is a net importer of gas from Canada, which is where this tariff will bite. Outside of those imports, there are also substantial exports to Canada and Mexico, which bear watching in the case of any escalation to this trade conflict. On balance, we think imported gas may absorb most of the price impact.

While Mexico is the clear net consumer of U.S. gas, Canada is the clear net supplier. In fact, Canada is the only significant non-domestic supplier of natural gas to the United States, at over 2.9 Tcf in 2023, and 2.8 Tcf through November in 2024 (up 7% y/y); this is where the tariffs bite. The U.S. also supplies gas to Canada, about 1 Tcf in 2023 and just under 0.9 Tcf through November 2024. There is a regional split where the U.S. supplies gas mostly to eastern Canada and imports from western Canada, but on balance the U.S. is a clear net importer in any case.

In terms of those volumes flowing from Canada to the United States, we think that they will continue to flow, at least for now, because if they did not, they would either have to be injected into storage or not produced – the latter of which would take time and have other consequences – and LNG Canada will eventually provide a partial release valve. Affordable Canadian gas is an attractive and important source for U.S. consumers, and some market participants believe tariffs are already factored into the market for Canadian gas prices.

On balance, however, we think Canadian gas prices will absorb at least some if not most of the price impact and that flows will continue. However, this is highly unlikely to lower U.S. gas prices and if there is an impact, it would be to raise U.S. natural gas prices for U.S. consumers.

To access the full report, contact your RBC representative.